美國總統拜登5月10日表示,白宮可能會取消特朗普任期對中國輸美商品加征的部分關稅,以平抑物價。白宮正在審查這些關稅,并可能選擇將其一并取消。本文作者認為,加征關稅成本被轉嫁給美國制造商和消費者,美國目前通脹持續高漲,而要想解決通脹問題,取消對中國商品加征的關稅才是明智的選擇。

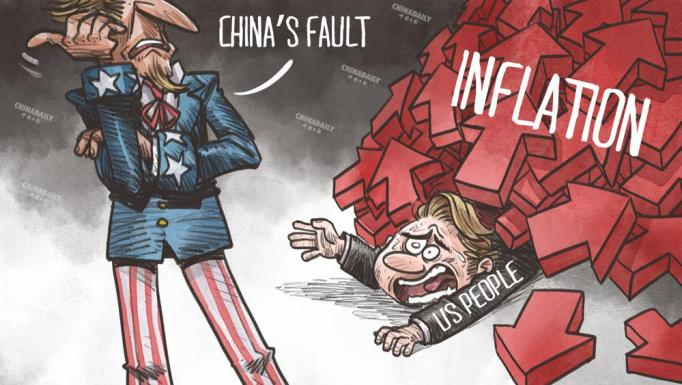

US President Joe Biden said on Tuesday that the White House could drop some of the Donald Trump-era tariffs on Chinese goods to lower consumer prices in the United States, according to CNBC. The White House is reviewing the tariffs, and could opt to lift them altogether.

據美國消費者新聞與商業頻道報道,美國總統拜登5月10日表示,白宮可能會取消特朗普任期對中國商品加征的部分關稅,以降低美國的消費價格。白宮正在審查這些關稅,并可能選擇將其一并取消。

There have been constant appeals by a large number of business leaders to reduce, if not altogether lift, the tariffs on Chinese goods, to help reduce skyrocketing inflation in the US. And senior US officials, including Treasury Secretary Janet Yellen and more than 140 Congress members, have been discussing the issue for some time now.

許多商界領袖不斷呼吁取消或至少是減少對中國商品征收的關稅,從而緩解美國飆升的通貨膨脹率。包括財政部長珍妮特·耶倫和140多名國會議員在內的美國高官已經就該問題商討了一段時間。

The consumer price index in the US broke the 7 percent mark in December 2021, the highest since 1982, and has continued to increase since the start of 2022, hitting 7.9 percent in February and 8.5 percent in March, forcing the Federal Reserve to raise interest rates by 50 basis points on May 4, the largest rate hike in 22 years. The CPI for April is 8.3 percent, somewhat abated, though still high.

2021年12月,美國消費者價格指數(CPI)突破了1982年以來的最高紀錄7%,并自2022年初持續上漲,2月和3月分別達到7.9%和8.5%,這迫使美聯儲在5月4日加息50個基點,這是美國22年來最大幅度加息。4月份的CPI高達8.3%,但較之前有所下降。

A week before Biden's remarks, on May 3 to be precise, the US Trade Representative issued a notice on statutory four-year review of Section 301 tariffs on Chinese goods. It said that, according to the US Trade Expansion Act 1974, Section 301 tariffs on Chinese goods expire on July 6, so those that have benefited from the tariffs should submit their opinions on an extension before that date. If their requests are in favor of an extension, the tariffs will continue beyond July 6.

準確地說,在拜登發表講話的前一周,即5月3日,美國貿易代表發布了一份關于根據“301條款”對中國商品加征關稅的四年法定復審通知。聲明稱,根據美國《1974年貿易法》,對中國商品加征的“301關稅”將于7月6日到期,因此那些受益于對華加征關稅的美國國內行業代表應在該日期之前提交延期意見。如果他們支持延期,7月6日之后將繼續征收這些關稅。

The Trump administration had imposed tariffs on Chinese goods in steps. Hence, the statutory review for the rest of the tariffs will be completed only by Sept 1, 2023.

特朗普政府逐步對中國商品加征了關稅。因此,其余關稅的法定復審將在2023年9月1日之前完成。

If the White House follows that course, the reduction in tariffs will be too small, too late to help reduce inflation. Instead, the right choice would be to lift the tariffs altogether.

如果白宮遵循這一方針,關稅削減規模太小,行動太遲,將無法幫助降低通脹。相反,正確的選擇是完全取消這些關稅。

First, the lifting of all the tariffs could quickly bring down the CPI in the US. A recent policy brief by the Peterson Institute of International Economies estimated that the removal of tariffs on Chinese goods including steel and aluminum could reduce the CPI by 1.3 percentage points.

首先,取消這些關稅可能會迅速降低美國的CPI。彼得森國際經濟研究所最近發布的一份政策簡報預測,取消鋼鐵和鋁等中國商品的關稅可能會將CPI降低1.3個百分點。

The figure is close to that calculated by the Chinese government in a white paper issued in 2018. According to the white paper, the lifting of tariffs on low-cost imports from China will reduce the CPI in the US by 1 to 2 percentage points. Why? Because tariffs are paid by importers, not exporters, which in this case are US companies that pass the added cost down to the consumers, be they the downstream manufacturers or individual buyers.

這一數字與中國政府在2018年發布的白皮書中估算的數字接近。根據這份白皮書,對從中國進口的低成本商品取消關稅將使美國的CPI降低1到2個百分點。這是為什么呢?因為關稅是由進口商支付的,而不是由出口商支付的,在這種情況下,美國公司將增加的成本轉嫁給消費者,無論是下游制造商還是個人買家。

A Moody's study has found that 92.4 percent of the added tariffs on Chinese imports are borne by the US side. And a joint study by the US-China Business Council and Oxford Economics found that tariffs on Chinese imports had reduced the US' GDP by $108 billion, or 0.5 percent, and household incomes by $88 billion in 2018-19.

穆迪公司的一項研究發現,美國對中國進口商品征收的附加關稅中有92.4%由美方承擔。美中貿易委員會和牛津經濟研究院聯合開展的一項研究發現,2018-2019年間,對中國進口商品征收關稅使美國國內生產總值(GDP)減少0.5%,即1080億美元(約合人民幣7308億元),家庭收入減少了880億美元(約合人民幣5955億元)。

Second, the tariffs have been of virtually no use in checking Chinese exports to the US. According to China customs data, Chinese exports to the US hit an all-time high in 2021-$576.11 billion, up 20.4 percent over 2018, when the previous record was set before the effects of the tariffs were felt.

第二,這些附加關稅在限制中國對美出口方面幾乎毫無作用。根據中國海關數據,中國對美出口在2021年創下歷史新高5761.1億美元(約合人民幣38975.6億元),較2018年增長20.4%。2018年時加征關稅的影響尚未顯現。

Compared with 2020, Chinese exports to the US rose by 27.5 percent, more than that to ASEAN member states (26.1 percent) which didn't impose any additional tariffs on Chinese goods. Since the US tariffs have made no difference to bilateral trade, what is the rationale of keeping them?

與2020年相比,中國對美國的出口增長了27.5%,超過了對東盟成員國(26.1%)的出口增長,后者沒有對中國商品征收任何額外關稅。既然美國加征關稅對雙邊貿易沒有影響,那么為什么要保留關稅呢?

And third, the US is obliged to follow international rules. A World Trade Organization panel found that the Section 301 tariffs violate the General Agreement on Tariffs and Trade clauses and are thus illegal. As a member of the WTO, the US has no excuse to continue with the tariffs, still less to keep using them as a bargain. In fact, the PIIE policy brief said the US should pursue trade liberalization to reduce inflation.

第三,美國有義務遵守國際規則。世界貿易組織的一個小組發現,“301關稅”違反了《關稅及貿易總協定》的條款,因此是非法的。作為世貿組織成員國,美國沒有理由繼續加征關稅,更不用說繼續將其作為一種討價還價的手段。事實上,彼得森國際經濟研究所政策簡報稱,美國應該追求貿易自由化以降低通脹。

Based on the three reasons, the correct choice for the Biden administration would be to swiftly lift all the added tariffs on Chinese goods. The move will result in three immediate benefits. It will help reduce the highest inflation in the US in 40 years, be a good gesture toward improving Sino-US trade relations, and a step in the right direction to show the US is back to following WTO rules.

基于這三個原因,拜登政府的正確選擇是盡快取消對中國商品征收的所有附加關稅。此舉將帶來三個立竿見影的好處:將有助于降低美國40年來最高的通貨膨脹率;是改善中美貿易關系的一個良好姿態;也是表明美國重新遵守世貿組織規則,朝著正確方向邁出的一步。

The author is a senior fellow at the Center for China and Globalization.The views don't necessarily reflect those of China Daily.

本文作者何偉文是中國與全球化研究中心高級研究員。文章觀點并不代表本網站立場。

編輯:董靜

來源:中國日報